Sertai Cabaran PU Xtrader Hari Ini

Berjual beli dengan modal simulasi dan peroleh keuntungan sebenar selepas anda lulus penilaian pedagang kami.

Sertai Cabaran PU Xtrader Hari Ini

Berjual beli dengan modal simulasi dan peroleh keuntungan sebenar selepas anda lulus penilaian pedagang kami.

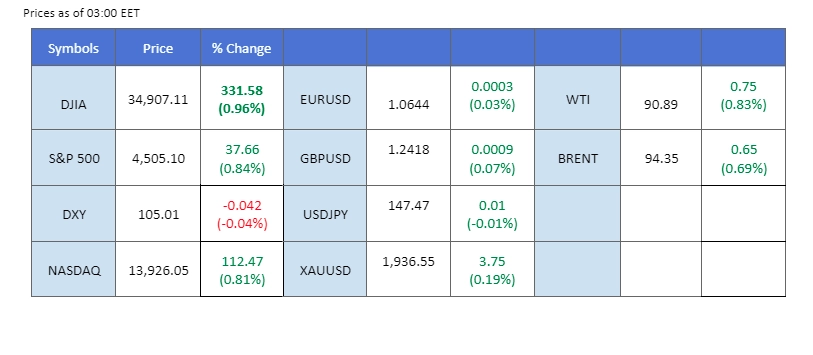

Upbeat U.S. economic data, particularly Retail Sales and Initial Jobless Claims, ignited a rally in both the dollar index and equity markets. Investors are now bolstered by their confidence in the Federal Reserve’s ability to execute a soft landing strategy, deftly navigating the twin threats of a recession and surging inflation. Conversely, the European Central Bank’s unexpected decision to hike rates by 25 basis points last night triggered a near 1% slump in the euro. Market apprehensions are growing that elevated interest rates might further hamper the already dim economic prospects within the Eurozone. Meanwhile, China’s move to trim its bank reserve rate for the second time this year, aimed at boosting the economy through increased money supply, has provided a tailwind for China proxy currencies like the Australian and New Zealand dollars. These currencies stand to benefit from China’s stimulus efforts.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.0%) VS 25 bps (7.0%)

The U.S. Dollar has maintained its strength and has surged above the $105 level, driven by better-than-expected economic data. Retail sales growth exceeded expectations, and initial jobless claims came in lower than anticipated, signalling the continued health of the U.S. economy. Market sentiment is leaning towards the belief that the Federal Reserve can successfully orchestrate a soft landing, with the economy avoiding recession, and interest rates remaining in the higher, restrictive territory for an extended period to combat inflation.

The dollar index rose to above the $105 mark, giving a solid bullish signal for the dollar. The RSI is approaching the overbought zone while the MACD rebounded before breaking below the zero line, suggesting the bullish momentum is strong.

Resistance level: 106.25, 107.10

Support level: 104.25, 103.05

Gold prices remain in a sideways trend, maintaining a bearish momentum, largely due to the sustained strength of the U.S. dollar. The dollar’s robust performance, supported by positive economic data from the U.S., has instilled confidence in investors regarding the U.S. economy. This confidence in the economy has resulted in decreased interest in gold, which is typically considered a safe-haven asset during uncertain times.

Gold prices still remain weak and are trading in a bearish momentum. The RSI has been flowing near the oversold zone while the MACD has a lower low pattern, suggesting a bearish signal for gold.

Resistance level: 1916.00, 1935.00

Support level: 1900.00, 1885.00

The euro experienced a significant decline, falling by almost 1% against the robust U.S. dollar yesterday. It is presently trading at its lowest level since June. This decline came despite the ECB’s unexpected decision to raise interest rates by 25 basis points the previous night. The market’s response was driven by concerns that the Eurozone’s already lacklustre economy might deteriorate further in the face of higher interest rates.

EUR/USD failed to defend at its crucial psychological support level at 1.0700, suggesting a bearish signal for the pair. The RSI is on the brink of dropping into the oversold zone while the MACD is suppressed below the zero line, suggesting a bearish sign for the pair.

Resistance level:1.0700, 1.0760

Support level: 1.0640, 1.0540

The British pound is ceding ground to the resurgent U.S. dollar, fortified by robust economic data unveiled last night. Market sentiment is now solidly in favour of the Federal Reserve’s capacity to engineer a graceful monetary policy transition, mitigating the dual risks of economic contraction and inflationary pressure. Conversely, the BoE’s hawkish stance has fallen short of stimulating investor interest in the GBP. This underwhelming response can be attributed to the UK’s lacklustre GDP growth, compounded by unexpectedly elevated wage growth, both of which are casting a shadow over the nation’s economic outlook.

The Sterling drop below a descending triangle price pattern has given a solid bearish signal for the Cable. The RSI constantly flows in the lower region while the MACD has been hovering below the zero line, suggesting a bearish bias for the Cable as well.

Resistance level: 1.2460, 1.2540

Support level: 1.2390, 1.2300

The Japanese yen has held its ground against the strengthening dollar and traded steadily. Market uncertainty regarding the Bank of Japan’s potential monetary policy shift and the possibility of scrapping its Yield Curve Control (YCC) policy has left USD/JPY without a clear direction. Additionally, China’s decision to cut its bank reserve rate for the second time this year has boosted positive sentiment in the Asia region and provided support for the weakened Japanese yen.

The USD/JPY pair has been trading relatively sideways in September. Both the RSI and MACD have given a neutral signal for the pair as both are flowing flat simultaneously.

Resistance level: 148.90, 151.45

Support level: 145.00, 141.90

The U.S. equity markets experienced significant gains, with all major indexes rising by nearly 1%. The Dow Jones Industrial Average led the way, gaining 331.50 points. These gains were fueled by positive data regarding the U.S. economy, including robust Retail Sales and Producer Prices figures despite rising energy costs, contributing to optimism surrounding the equity market. Investors are increasingly confident that the Federal Reserve can successfully implement a monetary policy that achieves a soft landing, effectively balancing the risks of both recession and inflation.

The Dow is testing the break its short-term resistance level at 35000, suggesting a bullish signal for the index. The RSI is slowly moving toward the overbought zone while the MACD is on the brink of breaking above the zero line, suggesting the bullish momentum is forming.

Resistance level: 35500.00, 36500.00

Support level: 34500.00, 33700.00

The Australian dollar has managed to hold its ground against the strong U.S. dollar, which has been bolstered by robust U.S. economic data. The Australian employment data released recently has led the market to anticipate that the Reserve Bank of Australia (RBA) might consider continuing its monetary tightening cycle, providing support for the Aussie dollar. Additionally, China’s decision to cut its bank reserve requirement for the second time this year indicates the Chinese government’s determination to address its economic challenges, further bolstering the Aussie dollar.

The RSI and the MACD suggest that the AUD/USD pair is forming a bullish momentum as the RSI hovers near the overbought zone and the MACD breaks above the zero line.

Resistance level: 0.6500,0.6610

Support level: 0.6370, 0.6200

Oil prices continue their upward surge, breaching the psychological resistance level of $90, a clear indicator of a robust bullish trend. This surge has seen oil prices climb by almost 4% in the current week. The driving force behind this increase is the decision by major oil producers Saudi Arabia and Russia to extend their oil output cuts. This has raised concerns in the market about a substantial supply shortage looming throughout the fourth quarter of 2023.

Oil prices continue to trade in a bullish momentum and trade above $90 and at the highest level since last November. The RSI has been flowing at the higher territory, adding that the MACD has been hovering at above, suggesting that the bullish momentum is strong.

Resistance level: 92.30, 95.80

Support level: 87.70, 84.45

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

Pendaftaran Baru Tidak Tersedia

Kami tidak menerima pendaftaran baru buat masa ini.

Walaupun pendaftaran baru tidak tersedia, pengguna sedia ada boleh meneruskan cabaran dan aktiviti perdagangan seperti biasa.